The 15th Annual Global Shopper Study from Zebra Technologies confirms that shoppers are returning to shop in stores in similar numbers seen prior to the pandemic. They have also embraced self-serve habits as they increasingly use “do-it-yourself” (DIY) technology in stores, allowing retail associates more time on the floor to help shoppers.

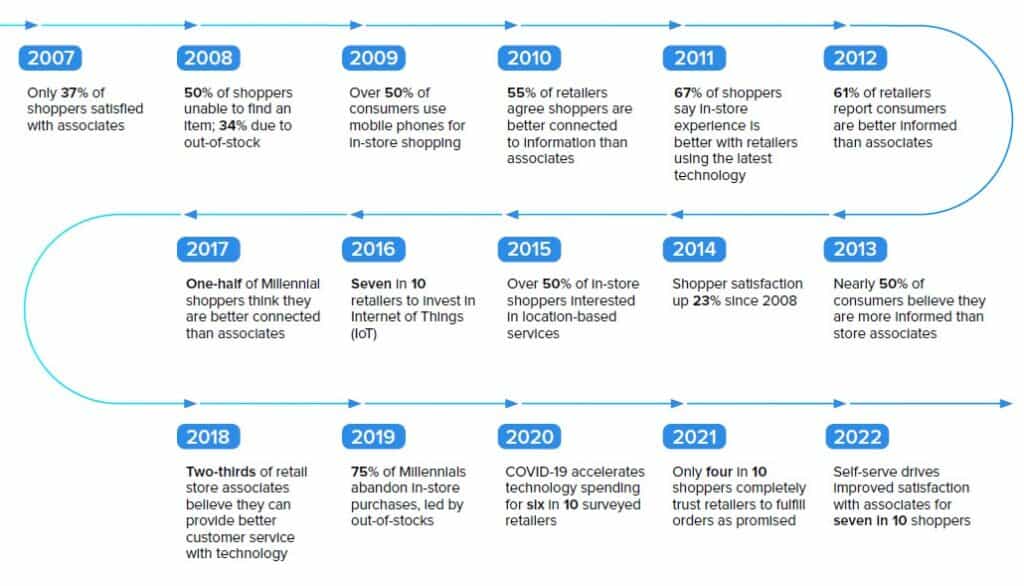

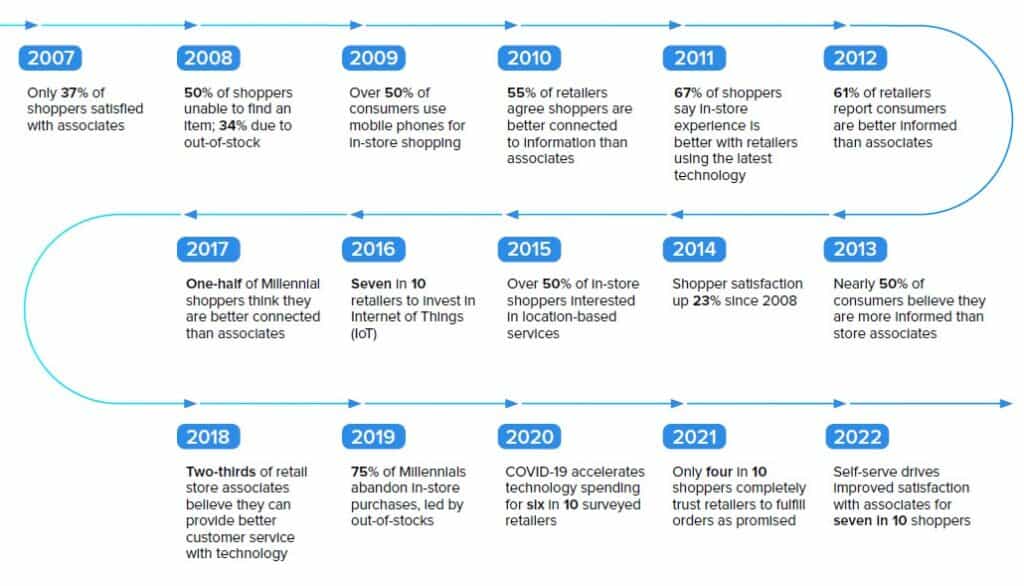

The annual report highlights changes in consumers, retail associates (front-line retail staff) and decision-makers among retailers over the 15 years the survey has been conducted.

Source: Zebra Technologies 2022

Gearing toward a mobile-first retail experience

Among surveyed shoppers in Asia-Pacific (APAC), 68% say inflation has caused them to delay purchases (compared to 75% globally). However, they are still returning to stores. However, most shoppers (76% globally, 68% APAC) want to get in and out as quickly as possible. They are also willing to help make that happen with their growing affinity for self-serve technology.

Preference for a traditional check-out register staffed by a store associate has similarly declined (51% in APAC).

This trend for using self-checkouts is now being echoed among retailers in APAC with 79% viewing staffed checkouts as less necessary, while 53% have converted store space to self-serve areas and 52% are offering contactless options.

Device shopping

Overall, shoppers are ready for technological advancements, with about eight-in-10 expect retailers to have the latest technology.

Among shoppers in APAC, 46% of those surveyed opted for cashless payment methods. Half of APAC respondents prefer paying with a mobile device or smartphone.

Consumers also continue to rely on their smartphones during shopping trips; this year’s usage indicates price sensitivity as over half of those surveyed are checking for sales, specials, or coupons (48% in APAC), aligning with a good majority of shoppers (67% in APAC) concerned about having to reduce spending to make ends meet.

Everything experience

Consumers expect a seamless experience when they shop. Seven in 10 prefer shopping both in-store and online as well as favour online retailers that also offer brick-and-mortar locations. Convenience is king for fulfilment: most shoppers (73% in APAC) prefer the option to have items delivered and opt for retailers who offer in-store or curbside pick-up (64% in APAC).

The same is true for reverse logistics: about 77% in APAC prioritise their spending with retailers that offer easy returns. About 49% of surveyed retailers in APAC are converting space in their stores for order pick-up, supporting consumer fulfilment preferences.

Mobile ordering continues to increase, with around eight-in-10 shoppers and nine-in-10 millennials using it, and around seven-in-10 shoppers wanting more retailers to offer such services.

"With the convergence of retail channels today, retailers need to step up to meet renewed shopper expectations and ensure a seamless experience across their offline and online platforms,” said George Pepes, the APAC vertical solutions lead for retail and healthcare at Zebra Technologies.

“Furthermore, as the retail sector heads into the future of fulfilment, it is more important than ever for retailers to empower associates with the right technology to better perform their tasks.”

George Pepes

While 79% of global shoppers (76% in APAC) are concerned about inflationary price increases on everyday essentials, they are not necessarily leaving stores without the items they wanted due to price. Retail associates expressed out-of-stock complaints as their number one frustration (43% globally, 38% in APAC).

In APAC, the share of shoppers that do not complete their intended purchase order is lower overall (64%), with reasons including out-of-stock products (44%) or having found better deals elsewhere (27%).

Retailers are painfully aware of such reasons; 80% acknowledge the maintenance of real-time visibility for out-of-stocks as a significant challenge, needing better inventory management tools for accuracy and availability (84% in APAC).

Source: Zebra Technologies 2022

Leveraging labour

Generally, shoppers, retail associates and retail decision-makers agree shoppers have a better experience when retail associates use the latest technology to assist them.

In the face of labour shortages: 74% of surveyed retail associates in APAC and 82% of retail decision-makers agree that stores leveraging retail technology and mobile devices attract and retain more retail associates as well.

To further improve the shopping experience, more than eight-in-10 retailers surveyed aim to enable more retail associates or seasonal staff to help customers pick and fulfil online orders for the 2022 holiday season.

This also addresses another challenge cited by 73% of surveyed retailers in APAC: improving online fulfilment efficiency and expense (71%).

“To keep up with the ever-evolving retail landscape, retailers need to embrace intelligent automation and transform the way they integrate technology into their operations. Retailers also need to recognize that associates are a significant touchpoint to achieving long-term customer loyalty,” said Christanto Suryadarma, Southeast Asia (SEA) sales vice president for Zebra Technologies Asia Pacific.

“By equipping retail associates with the right technologies and processes, retailers will be well-prepared to respond to shoppers’ needs and deliver on-demand effectively.”

Christanto Suryadarma