As the global banking sector accelerates towards digital transformation, new research from Kearney’s APAC Retail Banking Radar reveals that while banks in the Asia Pacific (APAC) are at the forefront of digital adoption, physical branches remain crucial for certain high-value transactions. This challenges the narrative that traditional banking locations are becoming obsolete.

Key findings from the report highlight that APAC outpaces Europe by a median of 4.5% in digital adoption across various categories, particularly in investments and consumer finance. Digital channels now account for 60% of basic financial product activities in the region.

The widespread use of digital wallets epitomises this trend, with wallets representing over 70% of e-commerce transaction value and 50% of point-of-sale transactions in APAC—the highest globally.

However, when it comes to complex transactions such as mortgages and consumer lending, the appetite for in-person support remains strong. The report indicates that only 41% of mortgage-related activities and 59% of consumer lending transactions are completed digitally, underscoring the enduring importance of branches for more intricate financial products.

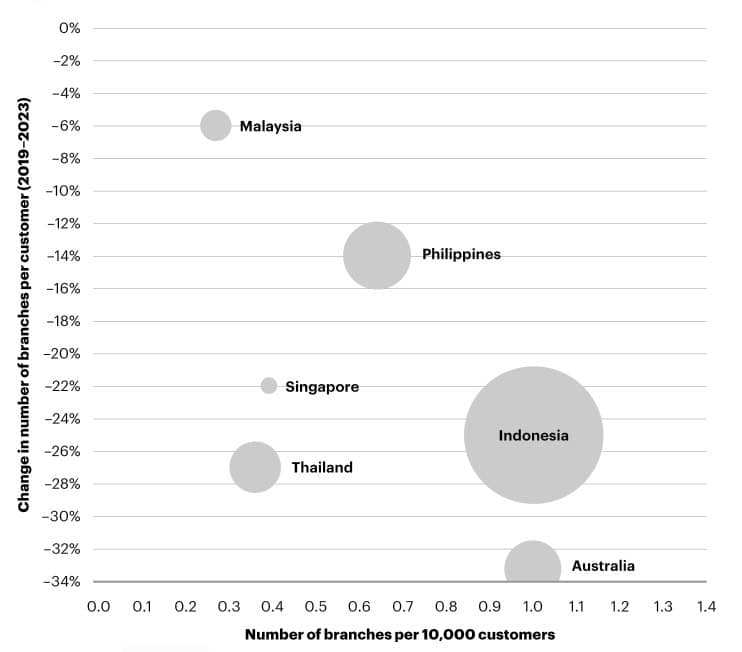

The evolution of physical branches is mixed across the region. While the total number of branches is declining in many areas, some countries are bucking this trend.

Malaysia saw a 1.3% increase in branch numbers, and the Philippines experienced an 8.5% expansion, targeting unbanked consumers. In stark contrast, Indonesia, despite having a 44% unbanked population, witnessed a 14.3% decrease in physical branches, with non-traditional lenders and neobanks grabbing 11% of the customer base.

Figure 1: Despite the global trend towards digital adoption, consumers in emerging and fast-growing economies still priotise face-to-face interactions

“Digital innovation is reshaping how customers research and purchase financial products," said Robert Bustos McNeil, Asia-Pacific Lead for Financial Services at Kearney.

"However, the need for trusted, face-to-face advice remains critical, especially in emerging markets and for complex transactions," he continued.

"Banks that balance digital capabilities with meaningful human engagement will be best positioned to thrive.” Robert Bustos McNeil

Mukund Bhatnagar, global lead for Financial Services, added, “Asia Pacific is setting the pace in digital banking, but the regional picture is far from uniform. Some markets are expanding branches to serve unbanked populations, while others lean into digital disruptors. Future success depends on how effectively banks can respond to evolving consumer behaviours and capture growth opportunities.”

As banks navigate this complex landscape, the challenge lies in integrating digital efficiency with the personalised service that customers still value. Far from signalling the end of branches, the research suggests a transformation, where physical locations adapt to meet the needs of a diverse customer base.