Following the COVID-19 pandemic, Philippines-based Rizal Commercial Banking Corp. (RCBC) jumped to fifth from ninth among the country's largest private universal banks in terms of assets. The lender credits the achievement to an innovation playbook that prioritizes and aligns the country's interests with its own.

The bank's total resources went up from 767.1 billion Philippine pesos in 2019 to 1.2 trillion pesos by the end of 2022, up approximately 56%, an impressive feat given that geographic constraints in the country of 7,100 islands impact the financial system. As of 2019, the Bangko Sentral ng Pilipinas (BSP) estimates that 71% of the population remains unbanked.

After the World Health Organisation (WHO) declared COVID-19 a pandemic, the Philippine government imposed stay-at-home orders with varying degrees of restrictions from March 2020 to March 2022, one of the longest lockdowns in Asia, resulting in severe limitations in the movement of people, goods and trade. In Metro Manila and 38 other provinces where business activities ground to a halt, people struggled to shift to digital channels to pay for basic goods and services and meet daily needs, while the most vulnerable sectors depend on financial aid.

“This pandemic puts banks on the frontline. We have now become part of the solution rather than the cause,” RCBC President and CEO Eugene S. Acevedo stated in the bank’s 2020 annual report.

The report noted that in the first year of the pandemic, RCBC rolled out ATM Go, its digital disbursement platform, which was one of the channels used to distribute the government’s financial aid to families affected by the lockdowns. By the end of the year, the bank has helped disburse 12.43 billion pesos of cash subsidy to more than 3.3 million households in 72 of the country’s 82 provinces.

Anticipating the impact of lockdowns on businesses, RCBC set aside 9.4 billion pesos in loan loss provision, which is 2.5x higher than the normalized provisions in the previous year. It also introduced the COVID Assistance and Recovery (CARE) program, which adjusted loan repayment terms for businesses based on “realistic expectations.” As of end-2020, the bank said 78.7 billion pesos of loans were placed under the program.

For its employees, it rolled out the pandemic and infectious disease plan, which includes health and safety protocols in the workplace, shifting to work-from-mode whenever possible, mobilizing its resources to allow nearly half of its branches in Metro Manila in Luzon to continue serving clients, and consolidating branches as foot traffic declined.

“At RCBC, we live by the mantra "innovations with empathy" and this inspires all members of the RCBC community to devote 100% of their skills, talent, and energy into conceptualizing designing and even offering products and services that are not only top-notch but reflects the desires or even lifestyles and aspirations of every Filipino,” said Lito Villanueva, chief innovations and inclusions officer.

Shift to digital

Established in 1960, RCBC is part of the bigger conglomerate, the Yuchengco Group of Companies, where Villanueva also serves as chief digital transformation advisor.

“In the past three to four years, we have successfully transformed RCBC from a purely brick and mortar traditional bank to a digital solutions behemoth and a leading digital challenger bank,” Villanueva said. “If there is a silver lining in COVID-19, that would be the quick adoption of consumers to digital financial solutions.”

Among the bank’s digital innovations is DiskarTech, the world’s first multilingual financial app launched in July 2020. It took only 30 days for the app to reach one million downloads, and enrolment rates reached 1.3 downloads per second, according to RCBC.

Regulated by the BSP, the app allows users to open a savings account, deposit or withdraw money, and purchase mobile loads and insurance. By the end of 2021, DiskarTech’s transaction volume has grown 437% from 2020. By then, there were already more than 45,000 DiskarTech touchpoints nationwide.

“We believe that innovation is possible and could benefit all Filipinos, and the key to that is inclusion. Our digital products and services are fruits of our objectives to include a greater segment of Filipinos into the formal banking system,” Villanueva said.

Scaling innovation is a huge challenge in an archipelago. Villanueva said the bank partners with grassroots organisations, private-sector partners and local government units. to realize its vision.

“Our partners on the ground helped us reach a greater segment of the Filipino people. It’s more than just one set of hands or one team. Our partnerships [also] make it easier for the government to understand pain points and expedite digital infrastructure projects,” he said.

Empathy in innovations

In 2020, the Philippine economy suffered a heavy blow, ending the year with a -9.5 % in GDP and reversing its 84 consecutive quarters of growth. Consumer spending was also at its slowest and unemployment has reached a 15-year record high of 10.3%, equivalent to 4.5 million Filipinos without jobs.

But even the worst crisis could open up windows of opportunities, according to Acevedo. As consumers quickly embraced new digital solutions and restrictions eased, the bank’s consolidated assets grew even bigger than its pre-pandemic levels. As expected, assets went down in 2020 slightly to 5.0 billion pesos from 5.4 billion pesos in 2019. However, it surged back up to 7.1 billion pesos in 2021 and 12.1 billion pesos in 2022.

“Empathy should be at the core of innovation,” Villanueva stressed. “It's high tech, yet high touch.”

According to Villanueva, “Empathy means having the people at the centre of every discussion about innovation. Innovative and successful solutions are widely patronized, and celebrate inclusion.”

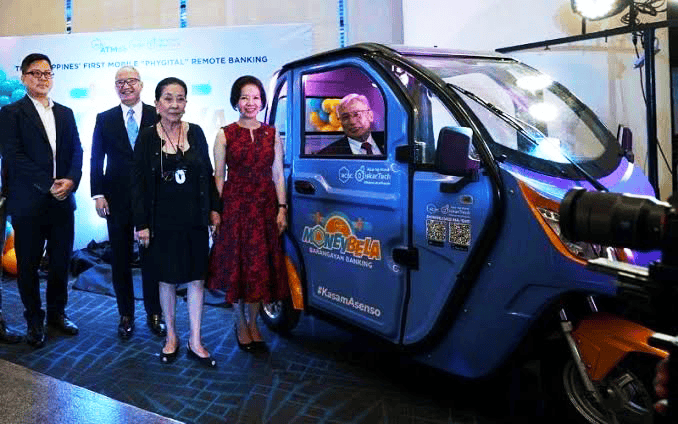

Among its empathy-driven digital banking innovations is a project dubbed MoneyBela Barangayan Banking, a hybrid product that combines the best features of digital banking and physical banking. Under this program, RCBC brings banking services, including basic deposit account creation, bill payment, e-load, cash in/cash out, micro insurance, and telemedicine, to previously underserved areas using sustainable electronic tricycles or e-trikes.

As the bank crossed the one-trillion-peso mark in assets, the bank expects the economic recovery to continue, while still on the lookout for the lag effects of higher inflation and any signs of COVID-19 resurgence, Acevedo said in the 2022 annual report.

“Our journey and commitment to reaching out to as many Filipinos and providing the best customer service remains never-ending,” Acevedo said.

* Editor's notes: This article is part of the Cxociety Coffee Table Book project (The Project) which chronicles the journey and experiences of senior business, operations, finance and technology leaders in Asia in recent years. The Project illustrates the tenacity, ingenuity and resiliency of the human spirit in the face of seemingly endless challenges.

With nearly 50 stories chronicled in The Project, it is a must-read compendium of learnings and experiences from seasoned professionals in the region.