Vehicle electrification and hybridization, alliances and collaborations among industry players, and rising consumer disposable income have indirectly stimulated the demand for automotive sensors. The intensified use of electronics in cars and an increase in the number of innovative product launches are also driving the automotive sensor market.

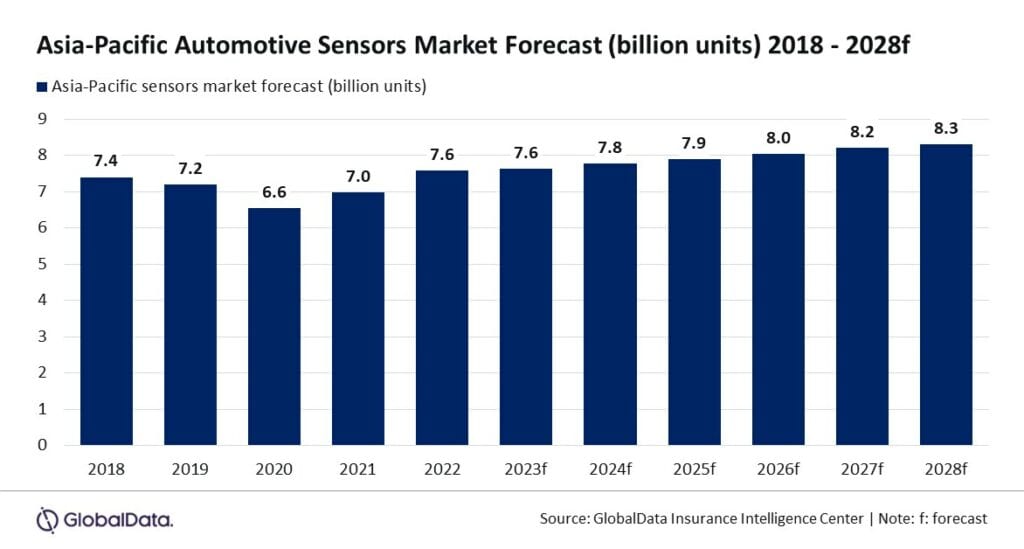

Against this backdrop, GlobalData forecasts the Asia-Pacific (APAC) automotive sensors market to register a compound annual growth rate (CAGR) of 1.7% over 2023-28.

GlobalData’s “Global Sector Overview & Forecast – Sensors” estimates the APAC automotive sensors market to reach 7.6 billion units in 2023 and 8.3 billion units in 2028.

The key proponents of sensors are parking assistance, interior technologies, gasoline direct injection (GDI), anti-lock braking system (ABS) adaptive cruise control (ACC), electronic stability control (ESC), crash, safety and body control, powertrain, and emission control. Both advanced driving assistance systems (ADAS) and global positioning systems (GPS) also require sensors.

Lucy Tripathi, senior automotive analyst at GlobalData, says the intelligent sensors are being used to control and process coolant levels, temperature, and oil pressure in vehicles.

"Increased electronic market competitiveness, ongoing device improvements, and increased automation in the automotive sector via electronic devices are anticipated to drive the automotive sensors market.”

Lucy Tripathi

Regional trends and opportunities

The APAC region, particularly China, is making a substantial contribution to the expansion of the global automotive sensors industry. China is also home to some of the biggest automakers in the world, which is expected to advance its automotive sensors market in the upcoming years.

Tripathi says China is expected to dominate the APAC automotive sensors market in the coming years. She cites lane departure warning, parking assistance, ACC, blind spot recognition, and forward collision warning as significantly boosting market growth.

"Due to their low cost, China has been able to deploy advanced sensors and semiconductors at an even faster rate than other countries in the region,” she added.

Safety & body control and powertrain & emission control sensors are expected to garner the largest share among all the sensors, primarily owing to the increased focus on driver assistance systems and fuel efficiency.

For example, Cipia’s driver monitoring system (DMS) employs computer vision and artificial intelligence (AI) to track the driver for signs of inattentiveness and fatigue while they are behind the wheel, making roads safer.

To watch out for potentially dangerous situations, the organisation monitors crucial indications, including gaze direction, blink rate, and eye openness. Additionally, it has the ability to detect smoking, precisely monitor the driver while a face mask is worn and ensure that seat belts are worn.

Tripathi comments that car buyers in APAC are increasingly interested in high-tech features like ACC, parking assistance, and accident avoidance.

"The rising use of automotive sensors is supported by large-scale production facilities and adherence to international quality standards, which is encouraging market expansion,” she concluded.