In 2025, the Asia Pacific region—home to over 58% of the world’s internet users—is witnessing a transformative leap in submarine cable infrastructure.

Opportunities abound in Japan’s emergence as a digital hub, and in the broader push for resilient, diversified networks that can withstand natural disasters and cyber threats. As demand intensifies, the region is poised to become a global leader in next-generation connectivity—if it can navigate the complex interplay of technology, politics, and security.

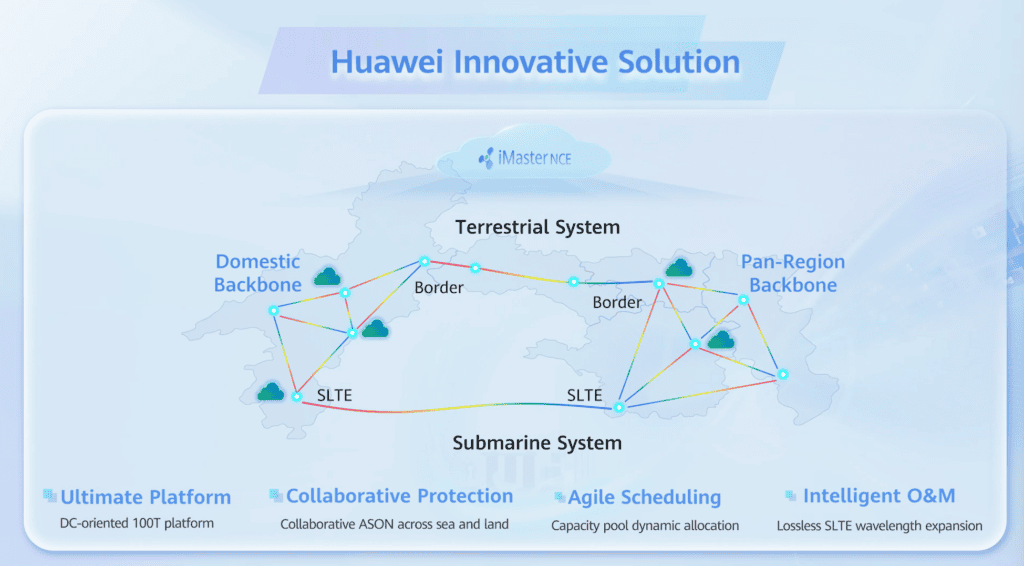

In September, Huawei unveiled its ambitious vision for Submarine-Terrestrial Synergy and Optical-Intelligent Orchestration. This strategic approach aims to break down traditional barriers between submarine and terrestrial networks, facilitating a more integrated and efficient communication infrastructure.

Huawei's new flagship product, the OptiX OSN 9800 K series, represents a significant leap in submarine-terrestrial integration. This platform is designed to handle massive cross-domain data transmissions and boasts an impressive service processing capability of up to 100 terabits per second (Tbps).

With features such as ultra-large capacity, high energy efficiency, and advanced intelligence for operations and maintenance (O&M), this solution is poised to transform the way data is transmitted across networks.

“Our aim is to build an integrated submarine-terrestrial network architecture that is ultra-broadband, highly reliable, and intelligent," said Gavin Gu, President of Huawei's Optical Transmission Domain.

"By enabling seamless transmission and significantly enhancing network O&M efficiency, we hope to set a new standard in the industry.” Gavin Gu

The platform’s energy efficiency is particularly noteworthy, with a power consumption of just 0.1 W/Gbit, which is 65% lower than the industry average.

The global submarine cable system market, valued at $4,701.6 million in 2025, is projected to experience steady growth, driven by escalating demand for high-bandwidth internet connectivity and the expansion of undersea data centres.

The increasing reliance on cloud computing and the proliferation of data-intensive applications, such as streaming services and the Internet of Things (IoT), are fuelling this demand. Furthermore, investments in 5G infrastructure and the ongoing development of subsea cable networks to support this technology are key growth catalysts.

Meta’s commitment to robust digital infrastructure is evident in its ongoing projects, including the Bifrost and Echo subsea cables, which are designed to increase transpacific capacity by 70%. The Bifrost cable connects Singapore, Indonesia, the Philippines, and the United States, while the Echo cable provides 260 Tbps of capacity between Guam and California.

As both Huawei and Meta continue to invest in the Asia-Pacific's digital infrastructure, their efforts underscore the importance of collaboration between technology providers and telecommunications companies.

The market is witnessing a shift towards higher-capacity systems, including those employing advanced technologies like coherent optical transmission and advanced fibre designs. This trend necessitates significant investments in research and development, ultimately benefiting leading players in the market.

However, challenges remain, including high initial investment costs, the susceptibility of cables to natural disasters and geopolitical instability, and the complex regulatory landscape in various regions. Maintaining long-term operational efficiency and ensuring the security of these crucial infrastructure systems are continuous priorities for market participants.

As Huawei and Meta advance their submarine cable projects, they are not only enhancing the region's connectivity but also contributing to a robust digital economy that supports emerging markets. Together, these initiatives promise to empower businesses and individuals alike with faster, more reliable access to information and digital services, paving the way for future innovations.