According to the Capgemini Research Institute’s latest report, “Navigating uncertainty with confidence – Investment priorities for 2025,” 62% of executives express confidence in their organisation’s prospects for the coming year, a notable increase from previous years.

Despite the overarching demand for cost containment, the report reveals a significant trend: 50% of organisations plan to increase their overall investment to enhance long-term competitiveness. This is particularly critical in a landscape where 56% of leaders prioritise cost reduction over revenue growth, indicating a strategic shift towards efficiency.

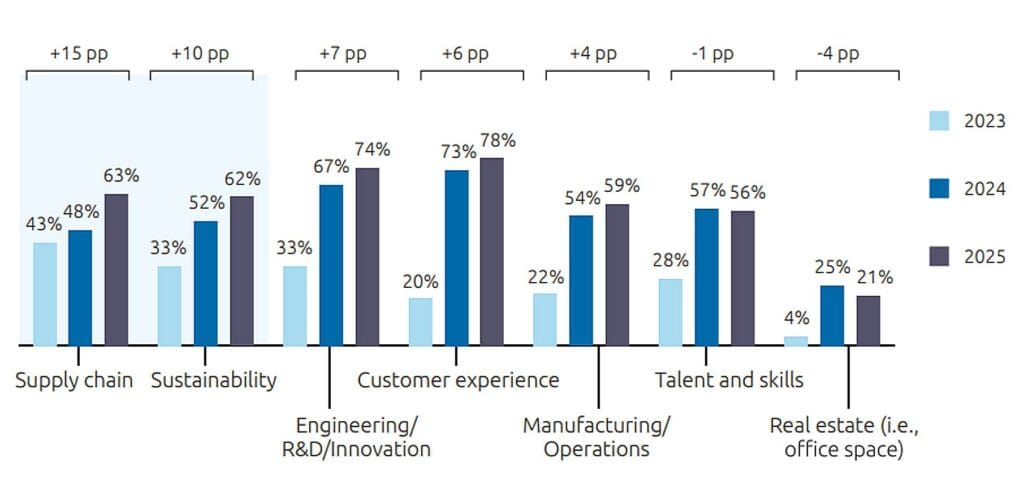

Percentage of business leaders among large organisations planning to increase investment in 2025

Aiman Ezzat, CEO of Capgemini, highlighted that “technology has a key role to play to improve competitiveness and productivity, while reducing costs and making all-important efficiency gains.” The report underscores that investment in customer experience, research and development, and innovation will be pivotal in navigating the uncertain market environment.

One of the most striking areas of growth is in supply chain transformation, with 63% of executives planning to boost spending in this domain—an increase from less than half in 2024. The integration of advanced technologies such as AI and IoT into supply chains promises to enhance efficiency, reduce waste, and contribute to sustainability goals.

In light of rising tariffs and trade disputes, organisations are proactively de-risking their supply chains. Approximately 70% of executives are concerned about the impact of these geopolitical factors on competitiveness, prompting a strategic shift towards diversifying sourcing options. Nearly 75% are now investing in emerging markets to lessen reliance on traditional manufacturing hubs, such as China.

Sustainability has also emerged as a key focus, with 62% of executives planning to increase their sustainability budgets by an average of 10.5%. Notably, climate technology is at the forefront, with 72% of leaders intending to allocate more resources to this area. Investments in batteries, renewables, and hydrogen are particularly prioritised, reflecting a broader recognition of sustainability as a vital business driver.

However, while optimism prevails, the landscape remains complex. Executives are acutely aware of the risks posed by geopolitical tensions and economic uncertainties, prompting a cautious yet proactive approach to investment. By focusing on innovation and resilience, businesses are not only preparing for future challenges but also positioning themselves to thrive in a rapidly evolving marketplace.

The report concludes that as organisations gear up for 2025, the emphasis on strategic investments in technology, sustainability, and supply chain resilience is set to define the business landscape, fostering a more innovative and adaptable global economy.