With the spread of 5G and the development of Internet of Things (IoT) devices, machine-to-machine payments will automatically execute contracts and make payments without human intervention, and possibly without network connectivity.

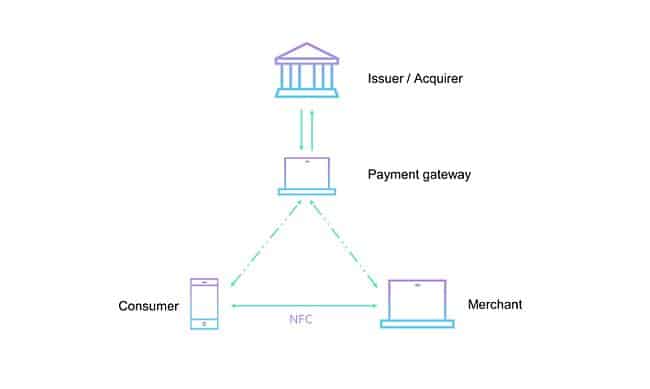

Japanese credit card provider JCB and Keychain GK have developed the first payment infrastructure for machine-to-machine transactions that supports offline payments using near-field communication (NFC).

This will enable offline payments, addressing the challenges related to the risks of operating through network outages and distributed attacks.

Under the collaboration, the two companies implemented the payment processing system using IoT devices, mobile phones, and smartwatches, and demonstrated the following:

1. Payments may be conditionally processed even during a double-offline scenario.

2. Payment processing consensus may be done over mixed networks simultaneously.

3. Upon network restoration, the offline transactions may be securely repatriated to online in batches.

Leveraging Keychain's blockchain and self-sovereign identity technology, the new infrastructure allows payments to be conditionally accepted by merchants, even in the event that both the payer and the merchant are disconnected from the network, a scenario known as double offline.

Notably, the shoppers' experience is as easy as swiping a smart watch at the store payment terminal with this system. The system uses NFC network protocol and leverages Keychain Core to support small IoT devices with, in principle, as little as 32 megabytes of memory.