What do you dislike most about going to the supermarket? Probably the long queue to the checkout counters, followed by rude or impersonal checkout clerk!

Retailers everywhere face intense pressure to provide differentiated and engaging in-store shopping experiences to their customers in the face of growing e-commerce and same-day delivery offerings. Physical retail establishments still account for 85% of retail transactions in the US, and these businesses must decide how to leverage mobile and digital solutions such as self-scanning and self-service technology in order to stay competitive.

Figure 1: handheld self-scanning solutions transforming efficiency in retail

Source: VDC Research 2019

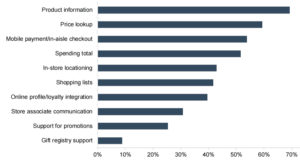

The grocery segment is currently leading self-scanning solution investments as grocers look to improve the shopping experience. To that end, retailers are beginning to deploy more sophisticated features such as shopper analytics, context- and location-aware promotions, and mapping services.

Many ISV’s and SI’s offer data collection and analysis services to retail clients using data from multiple touchpoints such as the POS and self-scanning devices. Retailers can bring these actionable insights into the physical store when making decisions.

According to VDC Research, Europe is currently the largest market by far for handheld self-scanning devices, although the market in the Americas will also grow at a significant rate through 2023.

“The deployment of Amazon Go was a catalyst for handheld self-scanning adoption in American markets,” said Spencer Gisser, research analyst at VDC. “Grocery stores in America saw customer preferences and expectations shift towards easy, technology-enabled self-checkout and rushed to implement new solutions,” Gisser explained.

To avoid investing in costly dedicated handheld self-scanning hardware, many retail organizations in the Americas are pursing apps that run on shoppers’ smartphones rather than dedicated devices. The large number of devices in EMEA will account for a significant replacement rate over the coming years whereas growth in the Americas will primarily stem from greenfield opportunities.

Self-scanning and self-service technology is part of a broader transformation among shopping experiences. “The most profound effects will take place once these solutions are integrated with other systems and processes involving locationing, customer information, and security,” Gisser said.

However, the market is struggling to understand how to deploy these solutions effectively. “Although many retailers are concerned that introducing these systems will increase theft, we have seen innovative strategies that have actually improved security and customer satisfaction.”