It’s that time of the year when we pull together predictions about what’s in store for the telecoms sector in 2018.

Recapping what we know

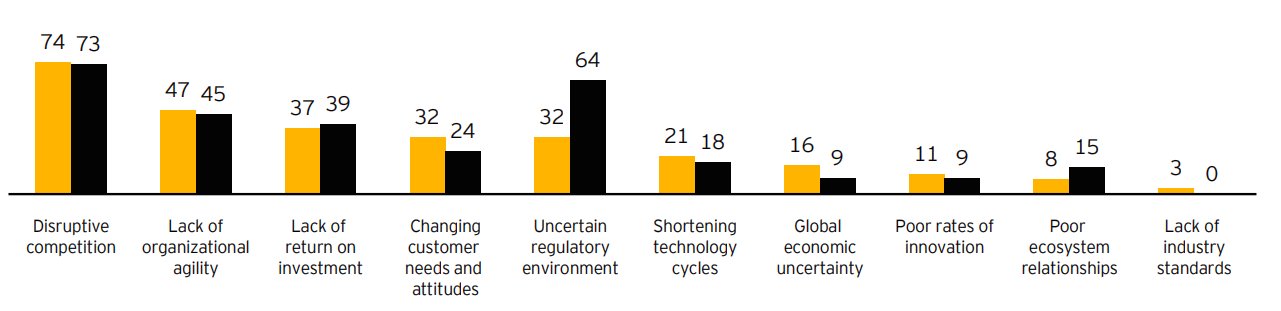

Like most other industries, concern about disruption is high on the agenda of carriers around the world. In a global survey of CIOs and CROs working at operators in the world, including familiar brands in Asia like HKBN, Yahoo Japan, Vodafone India, Telenor Group, Deutsche Telekom and Telstra, EY reported that participants cited the smartphone revolution and growth in mobile applications as opening the market to disruptive participants able to monetize new customer behavior.

Figure 1: Operators cite top 3 significant challenges for the industry

Source: EY 2017

According to the latest Ovum’s ICT Enterprise Insights program the telecoms sector is one of the most mature industries in the drive for digital transformation. However it also cited the industry as having a very low level of digital maturity with an index score of 43.9%, albeit still scoring better than other industry sectors including financial services.

More disruption ahead

“We think the telecoms sector will be the most disrupted with technology delivering mid-teen percentage impact,” said Sundeep Gantori, director, Equity Analyst, UBS AG.

In an exclusive video interview with TelecomAsia, Gantori cited, as an example, the decline in SMS revenues because people are using alternative social networking platforms. He also highlighted the emergence of eSIM, a service provider agnostic SIM that is embedded in devices like mobile phones and wearables, and will allow for easier operator switching by subscribers.

Gartner concurred that eSIM have the potential to supplant traditional lock-in strategies by operators.

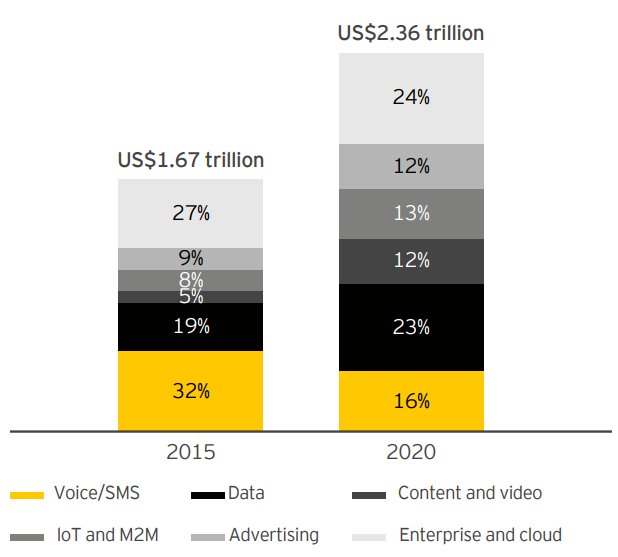

In the EY report, Digital transform for 2020 and beyond: a global telecom study, the consultant notes that diversification of revenue streams will be a mainstay strategy for the industry. EY cautioned that business expansion into adjacent market segments like enterprise cloud, TV and IoT will result in margin management challenges for operators because margins are slimmer and disruptive competitors are already entrenched in sectors like cloud and advertising.

Figure 2: Digital TMT ecosystem value forecast

Source: Informa, Ovum, GSMA, EY

EY concluded that rising IT spend will be part of the industry’s digital transformation strategy, and critical to supporting digital growth, with quality of experience and reduced costs at the heart of operators’ strategic agenda. Ovum forecasts global telco IT investments to reach US$85 billion by 2020, with 74% paid out to external providers rather than internal.

Ignored risks

EY listed 10 critical risk issues facing operators in the coming years. The failure to realize new roles in evolving industry ecosystems tops the list. Other risks include a lack of regulatory certainty on new market structures, ignoring new imperatives around privacy and security, failure to improve organizational agility, lack of data integrity to drive growth and efficiency, insufficient performance measurement to drive execution, failure to understand what customers value, inability to extract value from network assets, poorly defined inorganic growth agenda, and failure to adopt new routes to innovation.

Strategic directions next 3 years

Participants in the EY global telco study cited digital business models (71%), customer experience (61%), and cost control and business efficiencies (53%) as strategic priorities. Recognition by operators of the adjacent growth segments opportunities will necessitate acceptance of the need for new business models.

Figure 3: Top 3 operator strategic priorities from 2018-2020

Source: EY 2017

More important, operators recognize the symbiotic relationship of the top 3 priorities: digital business models, customer experience, and efficiency and agility gains.

EY concluded that it is “only by harnessing these related objectives as part of a common purpose do operators see themselves unlocking the full benefits of their transformation agenda. Nevertheless, the low relative focus on acquiring and retaining talent suggests that skills management may be lacking within this set of interconnected priorities.”