Despite recognising the complexity and risks that come with pursuing modernisation initiatives, digital transformation will continue in 2025 - if not accelerating even further.

According to the EY Reimagining Industry Futures study, over half of Singapore businesses are investing in generative artificial intelligence (GenAI) (54%) and the Internet of Things (IoT) (62%), reflecting a robust appetite for emerging technologies. However, many organisations struggle to transition from pilot projects to full-scale implementation.

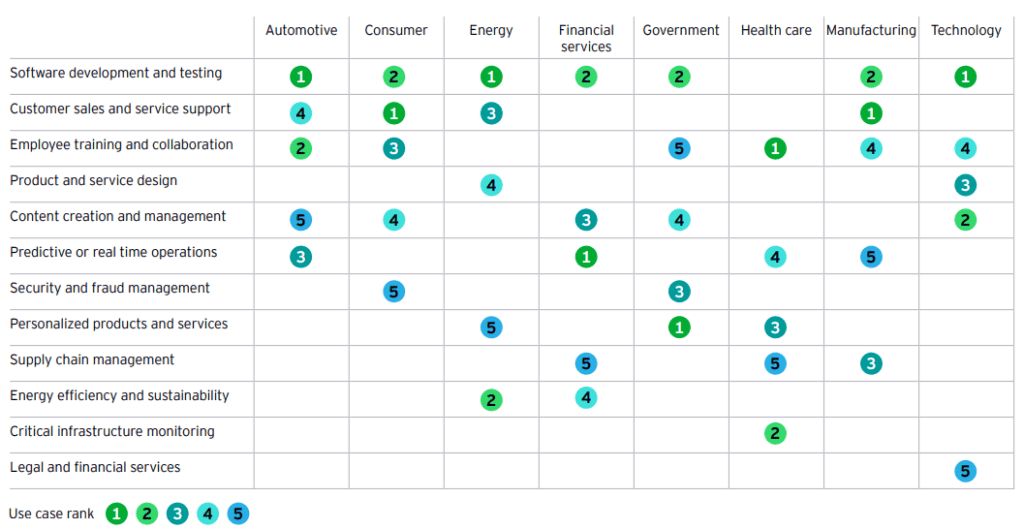

Top 5 GenAI applications by sector

The challenge of implementation

Despite significant investments, a staggering 77% of businesses in Singapore that are investing in GenAI remain at the proof-of-concept stage, with only 24% progressing to pilot projects. This gap highlights a critical challenge: while enterprises are eager to test new technologies, they often face integration hurdles that hinder broader adoption.

“While enterprises are keen to invest in emerging technologies, many struggle to bridge the gap between pilot and full-scale implementation,” says Joongshik Wang, EY's Asean Strategy and Execution Leader. This indicates that COOs must focus on developing clearer pathways for technology integration and demonstrating tangible return on investment (ROI).

Navigating supplierecosystems

The study also reveals a low level of awareness regarding ICT suppliers, complicating vendor selection for businesses. A significant 81% of respondents in Singapore express the need for a better understanding of the evolving supplier ecosystems. This lack of clarity can lead to difficulties in forming effective partnerships crucial for successful digital transformation. To address this, COOs should prioritise strategic relationships with suppliers that offer robust ecosystems and measurable business outcomes rather than merely focusing on cost advantages.

Focus on measurable outcomes

Interestingly, a third of Singapore respondents indicated that their ideal technology vendors should be able to provide measurable business outcomes rather than just technological benefits. This shift in focus illustrates the evolving expectations of businesses, with COOs needing to ensure that their suppliers can demonstrate clear value through their solutions. The ability to scale and integrate diverse technologies is also a top priority, as businesses look to reduce complexity and enhance operational efficiency.

Supplier consolidation trends

In light of these challenges, many enterprises are considering consolidating their vendor base, with 41% of Singapore respondents planning to reduce the number of ICT vendors they engage with over the next year. This strategy aims to improve security, compliance, and overall expenditure on technology suppliers.

Wang emphasises the importance of ICT suppliers in digital transformation success, stating, “ICT providers must co-develop industry-specific solutions, strengthen ecosystem collaboration, and drive data-led strategies.”

For COOs in Asia, 2025 presents both challenges and opportunities in the realm of digital transformation. By focusing on effective vendor partnerships, measurable outcomes, and strategic supplier consolidation, they can navigate the complexities of emerging technologies and drive their organisations towards sustainable growth. As the landscape evolves, the ability to adapt and innovate will be crucial for success in this digital age.