The surgical robotics industry has quadrupled to more than US$3 billion and is positioned to continue to balloon throughout the next decade.

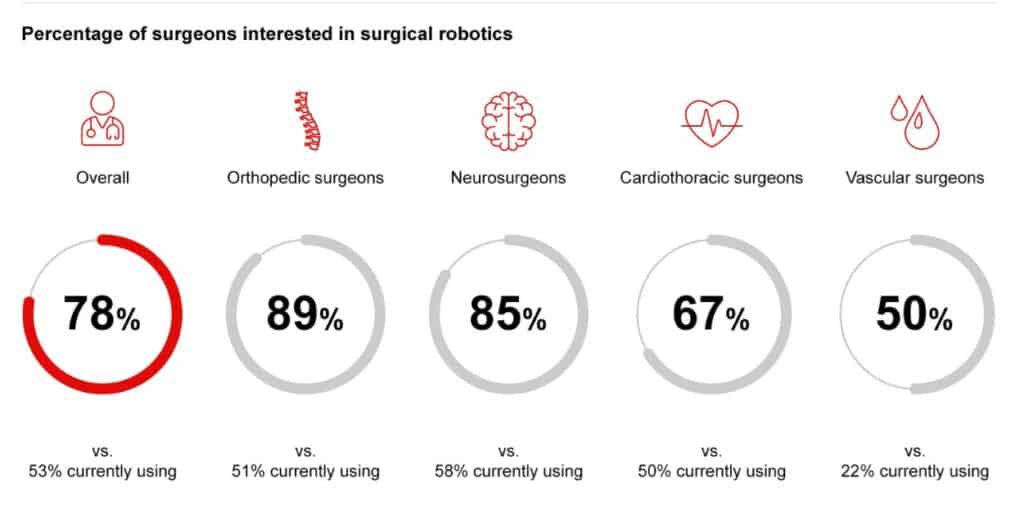

According to a Bain & Company report on the state of robotics as used in healthcare, 78% of surgeons surveyed expressed interest in surgical robotics, however, only 53% were currently using them. Currently, general surgery is the most advanced surgical robotics technology, however, indicators suggest that orthopaedics and neurosurgery will grow substantially.

Mayuri Shah, a partner at Bain & Company says orthopaedics and neurosurgery benefit from technology and training that are already happening with medical residents.

“With the technology and training accessible for many of these specialities, such as spinal surgeries, usage is bound to accelerate significantly in the near future. In addition to increased training, OEMs can leverage existing surgical robotic platforms where there is familiarity and usage for new surgeries and specialities,” she added.

Technology, innovation and artificial intelligence continue to have a significant influence on surgical robotics. While some specialities have the platforms and the training today, even the areas that look to be slower to adopt have strong opportunities. For example, soft robotics could eventually solve difficult access and navigation issues in endovascular surgery.

Successful med-tech companies and OEMs will take a customer-centric approach to the future of surgical robotics, addressing the current challenges to adoption and nuanced priorities by speciality and healthcare location.

Barriers to adoption

Bain’s survey of surgeons ranked up-front equipment costs as both the most important consideration when making a purchase, as well as the third largest barrier.

“OEMs will want to offer flexible financing options, in consideration of implant, disposables, to meet the preferences of each customer, said Jason Asper, partner at Bain & Company.

“Understanding the customer needs and preference for financing is critical. In addition, future surgical robotic market leaders and entrants should consider lower cost, smaller footprint robotic offerings, and focus on the efficiency to be achieved as new procedures are available, reducing per procedure cost.”

Jason Asper

Recommendations:

Cost and financing of surgical robotics: The Bain survey revealed that surgeons at hospitals and ASCs ranked up-front equipment costs as both the most important consideration when making a purchase and the third largest barrier to adoption. Flexible financing options can help. For instance, according to our survey, hospitals prefer all-cash financing, whereas nearly half of the ASCs want capital leases.

Site of care: The needs of each customer vary. As healthcare continues to move to outpatient customers will have different needs in ASCs vs acute settings. OEMs will want to consider how to best serve the market. For example, ASCs want vendor support for routine maintenance, whereas hospitals are more likely to want to train employees to service robotics.

Decision maker: It will be important to understand the needs of the decision-makers when reviewing the surgical robotics options. Clinical outcomes will be a priority to all stakeholders; however, some teams may prioritise revenue growth and surgeon recruiting and retention.

Speciality: As surgical robotics take off during the next decade, we’ll begin to see more specialised platforms and technologies.

Orthopaedic surgeons are looking for one robot to be able to perform several procedures, while Neurosurgeons see surgical robotics as an opportunity to overcome distance barriers and want robots that can operate remotely over greater distances, providing care from miles away.

Advancements in Technology: OEMs must continue to be out in front of technology or they can be disrupted – artificial intelligence, 5G, virtual/mixed reality and other technological advancements can significantly enhance capabilities of the robotics today.

In addition, OEMs should focus on strong data & analytics to best leverage data capture across the continuum of care to improve outcomes.