Financial services firms globally are increasingly adopting cloud technologies to boost agility, resilience, and innovation, moving beyond the traditional focus on cost reduction.

According to a new study by the London Stock Exchange Group (LSEG), 87% of firms have increased cloud spending in the past two years, prioritising strategic outcomes like scalability, revenue growth, and AI enablement.

The global survey of 453 financial services executives reveals that 82% now utilise multi-cloud or hybrid-cloud strategies, reflecting a desire for greater flexibility and risk diversification.

However, this shift isn't without its challenges. A significant 84% of respondents have had to adjust their cloud strategies to comply with regulatory frameworks such as the EU’s Digital Operational Resilience Act (DORA) and the General Data Protection Regulation (GDPR).

Stuart Brown, group head of data & feeds at LSEG, emphasises that cloud adoption is now a "key business imperative" rather than a technology-led decision.

He notes that companies are increasingly deriving value from the cloud, enhancing operational resilience, and preparing for the next wave of innovation driven by AI and machine learning. Financial institutions are leveraging the cloud to power fraud detection, risk management, data analytics, and generative AI.

Security remains a top concern, with 47% of respondents citing the sophistication of cyberattacks as their primary worry. Data privacy and potential breaches are also significant concerns.

Despite these worries, 92% of firms consider operational resilience a critical factor when selecting a cloud provider, highlighting the importance of trust and reliability in cloud partnerships.

Firms are experiencing tangible benefits from cloud adoption, with 54% reporting successful migrations and seeing value in areas like risk management, customer engagement, and enterprise data access.

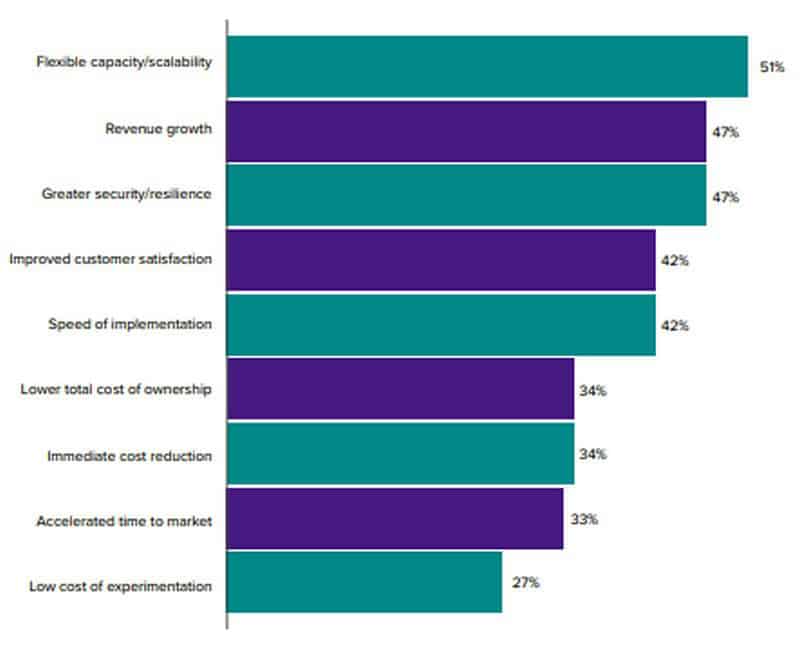

Notably, 83% of firms using the cloud for risk management have already completed their migration, marking the highest adoption rate among all use cases. ROI is increasingly measured by strategic outcomes, with scalability (51%), revenue growth (47%), and improved security and resilience (47%) taking precedence over immediate cost savings (34%).

Source: London Stock Exchange Group, 2025

While 61% of firms still report reduced IT infrastructure costs, particularly in EMEA and APAC due to regulatory complexities, the focus has shifted towards strategic gains.

The survey also indicates that 91% of firms are either using or planning to use cloud services for AI initiatives within the next 12 months. Generative AI (60%), fraud detection (50%), and risk management (50%) are the leading use cases.

As financial institutions look to the future, many are reconsidering their cloud service models. While SaaS remains dominant (43%), there is growing interest in PaaS and IaaS, suggesting a move towards building more bespoke applications in-house.

While cloud adoption is increasing, some reports indicate that the financial sector is moving to the cloud in a different way rather than simply a slower way. A report by Redgate Software indicates that only 29% of financial services host their production databases mostly or all in the cloud.

Overall, the LSEG survey underscores a significant shift in the financial services industry, with cloud technology becoming a cornerstone for competitiveness, innovation, and long-term growth .