Companies across a number of industries in Asia Pacific (APAC) from manufacturing, transportation and logistics, retail, post and parcel delivery and wholesale distribution are planning to deploy smart watches, smart glasses and hip-mounted wearables in their warehouse facilities.

In the latest Warehousing Vision Study, 73% of decision makers in the APAC region said that they are planning to make the investment in the next three years.

This is one of the key messages in the global study that included 1,403 (of which 352 were from APAC) IT and operational decision makers in the manufacturing, transportation & logistics, retail, post and parcel delivery and wholesale distribution markets in North America, Latin America, Asia-Pacific and Europe who were interviewed by Qualtrics, on behalf of Zebra Technologies. The study hoped to get insights into for the respondents’ current and planned strategies to modernise their warehouses, distribution centres and fulfilment centres.

Another key finding for the region is that 87% of respondents plan to implement a mobile execution system to better manage workers on the warehouse floor by 2024.

“Warehouse leaders today are turning to technology to address business critical challenges resulting from this global phenomenon, by adopting advanced technology and empowering their workers with a performance edge,” said Aik Jin Tan, APAC vertical solutions lead for manufacturing and transportation & logistics at Zebra Technologies. Zebra Technologies delivers industry-tailored solutions to elevate shopping experience, track and manage inventory as well as improve supply chain efficiency and patient care.

Meanwhile, Tan pointed out that expanding space, implementing new processes and enhancing workflows are only part of the equation.

“By 2024, warehouse leaders will be shifting their focus to the integration of more holistic solutions to build data-powered environments that balance labour and automation in the warehouse, ultimately empowering front-line workers with a performance edge to lead the way,” Tan said.

He added: “To match up to the on-demand mentality of consumers, decision makers will need to quickly train their front-line workers to fill orders more efficiently. Outdated Windows devices running green-screen applications are not designed to match the speed and volume of today’s on-demand economy.

“Conversely, modern Zebra Android touch-screen devices like the MC9300, MC3330R and MC3390R are designed for faster, more flexible operation that improves warehouse performance to meet the expectations of demanding consumers today.”

Key focus on automation and worker augmentation

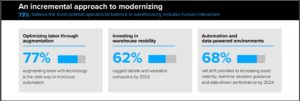

The study revealed that both automation and worker augmentation solutions will be a key focus for decision makers’ plans over the next five years.

More than three-quarters (81%) of respondents agree that augmenting workers with technology is the best way to introduce automation in the warehouse, but only 34% have a clear understanding of where to start automating.

More than three-quarters (81%) of respondents agree that augmenting workers with technology is the best way to introduce automation in the warehouse, but only 34% have a clear understanding of where to start automating.

Currently, up to 88% of decision makers are either in the process of or are planning to expand the size of their warehouses by 2024. Meanwhile, up to 85% anticipate an increase in the number of warehouses during this timeframe.

“The on-demand economy has fuelled that "want-it-now" mentality of consumers today, who are on the hunt for products almost 24/7. These demands have disrupted the supply chain, impacting manufacturers, retailers and the warehousing operations that serve their need,” said Fang-How Lim, regional director for Southeast Asia, Zebra Technologies.

He added: “Our study further revealed that 49% of the surveyed business leaders reported an increase in consumer demand as a top driver for growth, with almost 40% of respondents stating that shorter order lead times are fuelling their expansion plans and causing them to reanalyse their strategies.”

Below are some the key survey findings:

By 2024, automation will enhance worker performance rather than replace workers.

- 57% of decision makers plan to enable partial automation or labour augmentation with technology in the warehouse.

- 70% of respondents believe human interaction is part of their optimal balance in warehousing, with 43% citing partial automation (some human involvement) and 27% citing augmentation (equipping workers with devices) as their preference.

- Decision makers anticipate using robotics for inbound inventory management (27%), packing (24%) and goods in/receiving (21%) by 2024.

Rethinking fulfilment strategies and operations to meet emerging challenges across the warehouse remains a top priority.

- 68% of respondents cited capacity utilization as one of their top expected challenges over the next five years.

- 68% of organizations cited labour recruitment and/or labour efficiency and productivity among their top challenges, with 62% of respondents wanting to improve individual worker or team productivity today while also achieving workflow conformity.

- IT/technology utilization was identified both as the biggest operational challenge (68%) within the next five years and a desired long-term outcome for increased asset visibility, real-time guidance and data-driven performance.

- As warehouses expand, so will the volume of stock keeping units (SKUs) and the speed items need to be shipped. Decision makers will seek increased visibility and productivity by implementing more robust returns management operations (85%), task interleaving (85%), value-added services (84%) and third-party logistics (88%).

The investment and implementation of new technologies is critical for remaining competitive in the on-demand economy.

- Almost half (48%) of surveyed respondents cited faster delivery to end-customers as the primary factor driving their warehouse growth plans.

- Three-quarters (75%) of decision makers agree that they need to modernize warehouse operations to remain competitive in the on-demand economy but are admittedly slow to implement new mobile devices and technology.

- 73% of companies are currently modernizing their warehouses by equipping workers with mobile devices. By 2024, modernization will be driven by Android-based mobile computing solutions (90%), real-time location systems (RTLS) (60%) and full-featured warehouse management systems (WMS) (55%).

- 66% of respondents cited mobile barcode label or thermal printers as a key area of investment as part of their plans to add, expand or upgrade devices in the next three years.