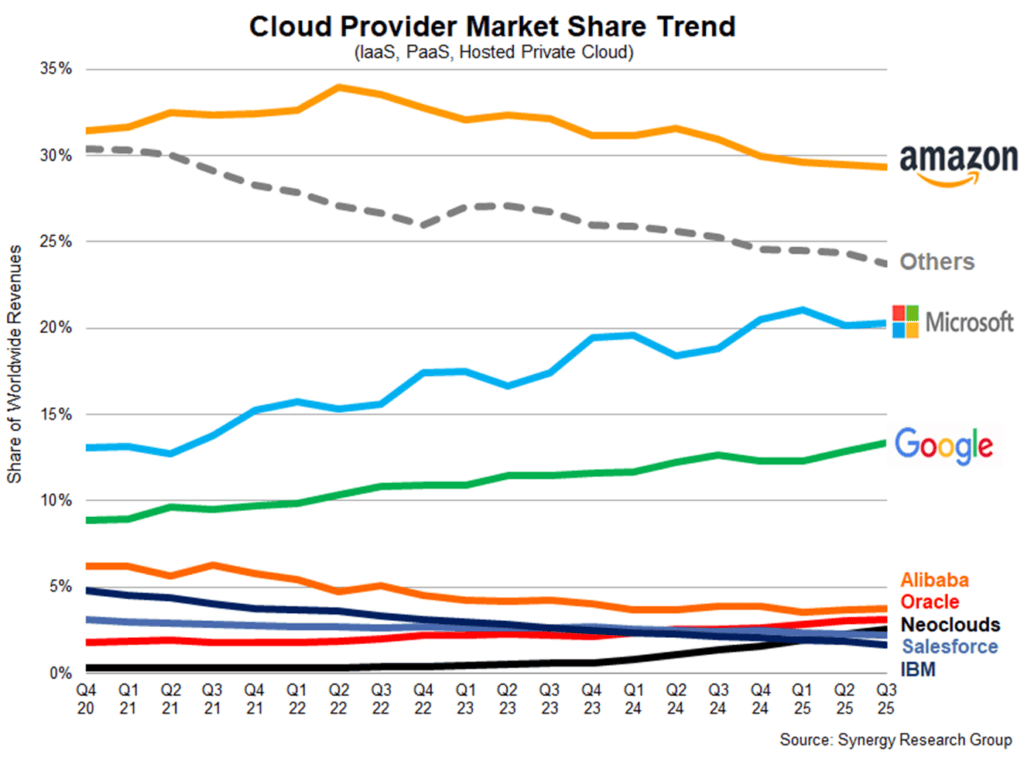

Recent data from Synergy Research Group highlights the continuing dominance of Amazon, Microsoft, and Google in the cloud infrastructure services sector, collectively accounting for 63% of enterprise spending in Q3 2025.

This marks a slight increase from 62% a year ago and 61% the year before that, reflecting the ongoing trend of market consolidation among these tech giants amidst a booming cloud market now valued at $107 billion, up from $68 billion eight quarters ago.

Despite the big three’s stronghold, Amazon’s share has gradually weakened. As of Q3, its market share stands at 29%, while both Microsoft and Google have made notable gains, holding 20% and 13% respectively. While the leaders maintain significant market share, a noteworthy trend is emerging with Oracle and a group of neoclouds—newer entrants in the cloud space—showing increased momentum.

Among the neoclouds, CoreWeave has emerged as the largest player, followed by others such as Crusoe, Nebius, and Lambda, all of which are experiencing rapid growth. Meanwhile, Alibaba and Salesforce continue to expand their revenues in the cloud services sector, albeit at a slower pace than the overall market, resulting in a slight loss of market share. IBM’s revenues, on the other hand, have largely plateaued as the company shifts its focus and strategy.

Synergy reports that Q3 revenue for worldwide cloud infrastructure services—including Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and hosted private cloud services—touched $106.9 billion, contributing to trailing twelve-month revenues of $390 billion. The bulk of the market is dominated by public IaaS and PaaS services, both of which grew by 30% in Q3.

Geographically, the demand for cloud services remains robust across all regions. In local currency terms, the strongest growth is seen in countries such as India, Australia, Indonesia, Ireland, Mexico, and South Africa, each outpacing the global average.

“Given the massive scale of this market, quarter-to-quarter shifts in market share tend to be minimal,” commented John Dinsdale, chief analyst at Synergy Research Group.

“Amazon’s market share has averaged just under 30% over the past four quarters, down from just over 32% in 2021. Its diminishing share contrasts with Microsoft and Google’s gains, yet Amazon remains effective in maintaining its leadership position.” John Dinsdale