Manual processes dominated work at Vietnam-based Vinacomin Motor Industry Joint Stock Company (VMIC), which manufactures parts for mining vehicles.

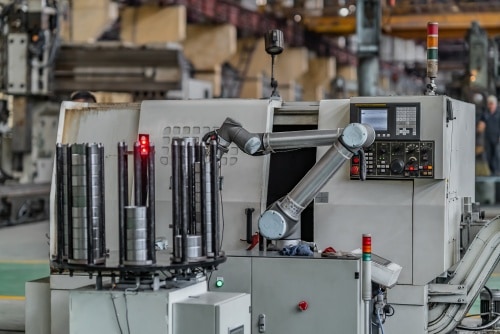

This reliance on physical labour resulted in low productivity and inconsistent quality. Customer numbers and orders were low, affecting workers’ income. Realising that it was imperative to embrace automation, the company deployed two UR10 cobots (collaborative robots) to undertake two tasks: pick and place and machine tending.

The state-owned coal and mining giant, a subsidiary of the Vinacomin Group, has sought the help of Universal Robots (UR) to future-proof production processes by deploying the latter’s popular cobots at its manufacturing plants.

VMIC reached out to local automation systems integrator Vnstar Automation JSC (Vnstar) - a partner of Servo Dynamics Engineering (Servo), a UR distributor in Vietnam - to automate its processes.

“Although new to robotics, VMIC’s engineering team successfully deployed the cobots in about a month after receiving three days of theoretical training and two days of hands-on experience from our team. We also provided proactive and responsive technical support, ensuring there was little disruption to the workflow,” said Kelly Kao, director at Servo Dynamics Engineering.

He pointed out that the cobots’ advanced safety features enable employees to work alongside the cobots safely, with no fencing.

“No changes were needed to the work space, saving costs while improving productivity,” Kao said.

To date, VMIC has seen productivity increase two to three times, with improved product quality, leading to a 50% to 60% percent rise in orders.

Darrell Adams, head of Southeast Asia & Oceania at UR said cobots continue to offer businesses in Southeast Asia vast benefits to transform their manufacturing processes and remain competitive.

“VMIC is exemplary of this, automating its once heavily-reliant manual processes and now boasting high productivity and better output quality,” he noted. “And we are the forefront of cobot technology, helping businesses like VMIC accelerate the transition to smarter production and sustainable growth.”

Vietnam is a key market for UR as automation demand rises. The automation and control market in Vietnam is estimated to be worth US$184.5million by 2021 according to Frost and Sullivan. Since its entry into the market in 2016, UR has doubled its network of distributors and systems integrators, covering Hanoi and Ho Chi Minh City.

Growing Adoption of Robotics in Southeast Asia

Adams expects greater cobot technology adoption in the Southeast Asia as companies realise the immense potential of automation.

Robot adoption is increasing in the region. According to the International Federation of Robotics, Asia is the largest industrial robot market, with over 280,000 units installed last year. While Southeast Asia makes up a small share of that total, the region has steadily seen an increase in installed robots annually. Thailand, Singapore, Vietnam, Malaysia and Indonesia are ranked among the 30 largest markets in 2018 with a total of 87,100 operational robots. The electronics and automotive industries remain the largest robot users in the region.

Singapore claimed the highest robot density globally in 2018 with 831 robots per 10,000 workers, followed by Malaysia and Thailand with 52 and 51 units each. Digitalisation and greater automation in industrial production is expected to drive robot installations. Countries such as Malaysia and Thailand are expected to see an average annual growth rate of 5 to 15 percent from 2020 to 2022.

“Beyond the mining industry, cobots are deployed in sectors such as automotive, electronics, textile, pharmaceuticals, footwear and food processing industries,” Adams said.

VMIC eyes further expand robotics adoption

In the next few years, VMIC aims to add three to five more UR cobots in order to automate more processes in their factories.

“Since using the cobots, our productivity has increased two to three-fold and product quality is now very consistent. This has led to a rise in orders, as much as 50% to 60% and subsequently, an increase in workers’ income,” said Pham Xuan Phi, CEO, VMIC.

He revealed that with the UR10 cobots, fewer workers are needed on the factory floor, enabling VMIC to assign some of them to higher-level tasks, which in turn increase worker satisfaction and reduce the risk of workplace accidents”

“Return on investment (ROI) in Vietnam for such robotic investment is typically between six to eight years, but we are expected to reach it within just one or two years,” Pham said.