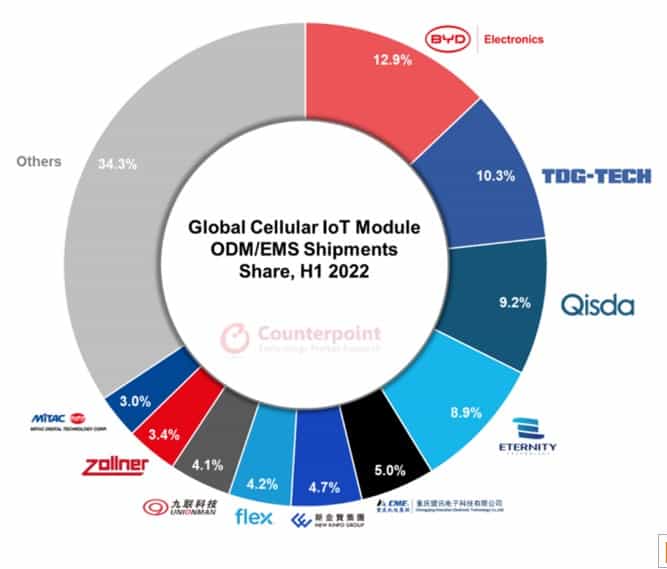

Global cellular IoT module outsourced manufacturing accounted for 52.4% of total IoT module shipments in H1 2022.

According to Counterpoint’s Global IoT Module Manufacturing Tracker, original design manufacturers (ODM) saw the fastest growth in H1 2022 at 45% YoY, followed by electronics manufacturing services (EMS) at 30% and in-house manufacturing at 21%.

After declining in Q1 2022, the global cellular IoT module market recovered in Q2 2022, despite macroeconomic headwinds and lockdowns in China, the largest IoT market.

Speaking on ODMs and EMSs, senior analyst Ivan Lam noted that in the past few years, leading Chinese OEMs have grown significantly in size.

“They have experience in managing supply chain partners and manufacturing allies. Leading OEMs have brought in multiple supplier policies to maintain their cost competitiveness, which gives them an advantage in terms of cost offering.”

Ivan Lam

Competitive landscape

The top 10 ODM/EMS players captured two-thirds of IoT module outsourced manufacturing in H1 2022. The leading ODM/EMS suppliers for IoT module manufacturing, such as BYD Electronics, TDG-Tech and Qisda, are mainly from Mainland China and Taiwan.

Among traditional EMS companies, Zollner, Jabil and USI led the top IoT module OEMs in their global expansion.

Lam added that manufacturing cost is still one of the key elements of an IoT module’s cost structure, apart from the cost of the components.

He explained that leading OEMs are growing rapidly in China, and they are likely to predominantly hire manufacturing partners that have production sites within the country.

“However, we observed that OEMs also hired EMSs with global production sites, such as production facilities in Mexico or Brazil to cater to the North America and LATAM markets. We forecast the manufacturing capacity utilization in India, Southeast Asia and LATAM will continue to grow given the significant increase in IoT module applications in these markets,” Lam continued.

Looking ahead

Commenting on the outlook for IoT module manufacturing, senior analyst Soumen Mandal said the firm expects outsourced manufacturing shipments to grow at a CAGR of 17% between 2021 and 2026.

He added that the soaring IoT module market, driven by innovation and digital transformation, especially in the enterprise segment, will play a pivotal role in IoT module manufacturing.

“IoT module players may focus on building platforms and services instead of manufacturing IoT modules as they present recurring revenue generation opportunities. This will also be an opportunity for ODM/EMS players to increase their footprint in the IoT module market.”

Soumen Mandal

“However, module players will try to increase control over the supply chain and look for vertical integration even for small components. This will help IoT module players reduce costs and remain competitive in the market," he cautioned.

“With higher demand in the market, top OEM players are also looking to expand their EMS supplier base to tap global markets,” Mandal concluded.