Hyperscale operators are rapidly expanding their data centre footprint. New Synergy Research Group data shows a significant shift. Hyperscale now accounts for 44% of global data centre capacity. This figure stood at just 1,189 facilities at the end of Q1 2025.

A majority of hyperscale capacity (over 50%) resides in owned data centres. The remainder is in leased facilities. Colocation accounts for another 22% of capacity. On-premise data centres now only hold 34% of the total. Six years ago, on-premise held almost 56%.

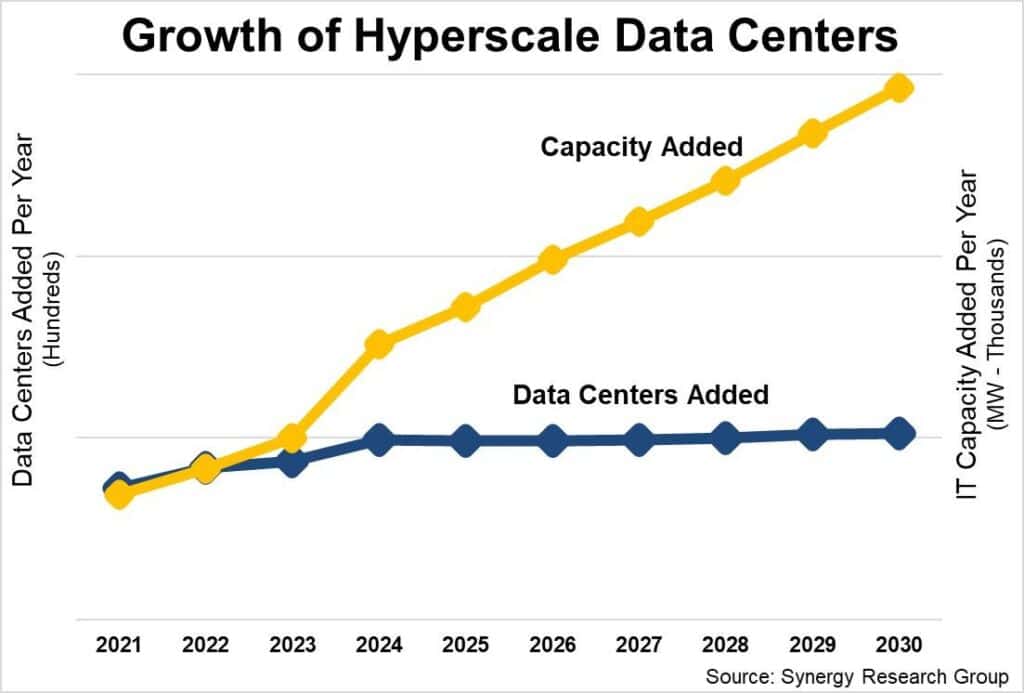

This trend will continue. By 2030, hyperscale will control 61% of capacity. On-premise will plummet to just 22%. Overall data centre capacity will increase rapidly. Hyperscale growth will be the primary driver, tripling in six years. Colocation will see capacity increases at near double-digit rates.

On-premise capacity is seeing a slight boost from GenAI. GPU infrastructure is also helping. However, its overall share will decline by 2% annually.

"Cloud and other key digital services have been the prime drivers," said John Dinsdale, chief analyst at Synergy Research Group. "The dramatic rise of AI technology and applications is now providing an added impetus."

Dinsdale also noted regional differences. Hyperscale owned data centres are more common in the US. EMEA and APAC regions lag behind. However, all regions will see double-digit annual growth. Hyperscale owned capacity will grow at least 20% per year across all regions.

According to a report by Mordor Intelligence, the Asia Pacific hyperscale data center market is expected to reach $319.08 billion by 2030, expanding at a CAGR of 24.49%.

The increasing demand for data centres has drawn interest from investors, including growth capital, buyout firms, real estate, and infrastructure investors.